The Yellow Card app

20th November, 2024

Yellow Card announced that it has secured a Crypto Asset Service Provider (CASP) license in South Africa. This will provide a critical boost to its service offerings.

This development comes after it partnered with Coinbase and Block to expand access to digital assets and cross-border payments.

In January 2024, Yellow Card partnered with Coinbase, a U.S.-based cryptocurrency exchange, to provide easy access to USDC and digital assets in 20 African countries. This collaboration allows Coinbase wallet users in Africa to make payments in their local currency via local bank transfers and mobile money, offering a more streamlined and enhanced customer experience.

Additionally, in 2023, Yellow Card partnered with Block, the U.S. fintech company behind Cash App and Square, to facilitate cross-border payments between 16 African countries, including Nigeria, Ghana, and South Africa. This partnership aims to enhance financial inclusion and provide more accessible financial services across the continent.

Now that it has obtained its CASP license, Yellow Card will be able to offer its cryptocurrency services within South Africa’s regulated financial framework, underscoring its commitment to compliance and growth across the continent.

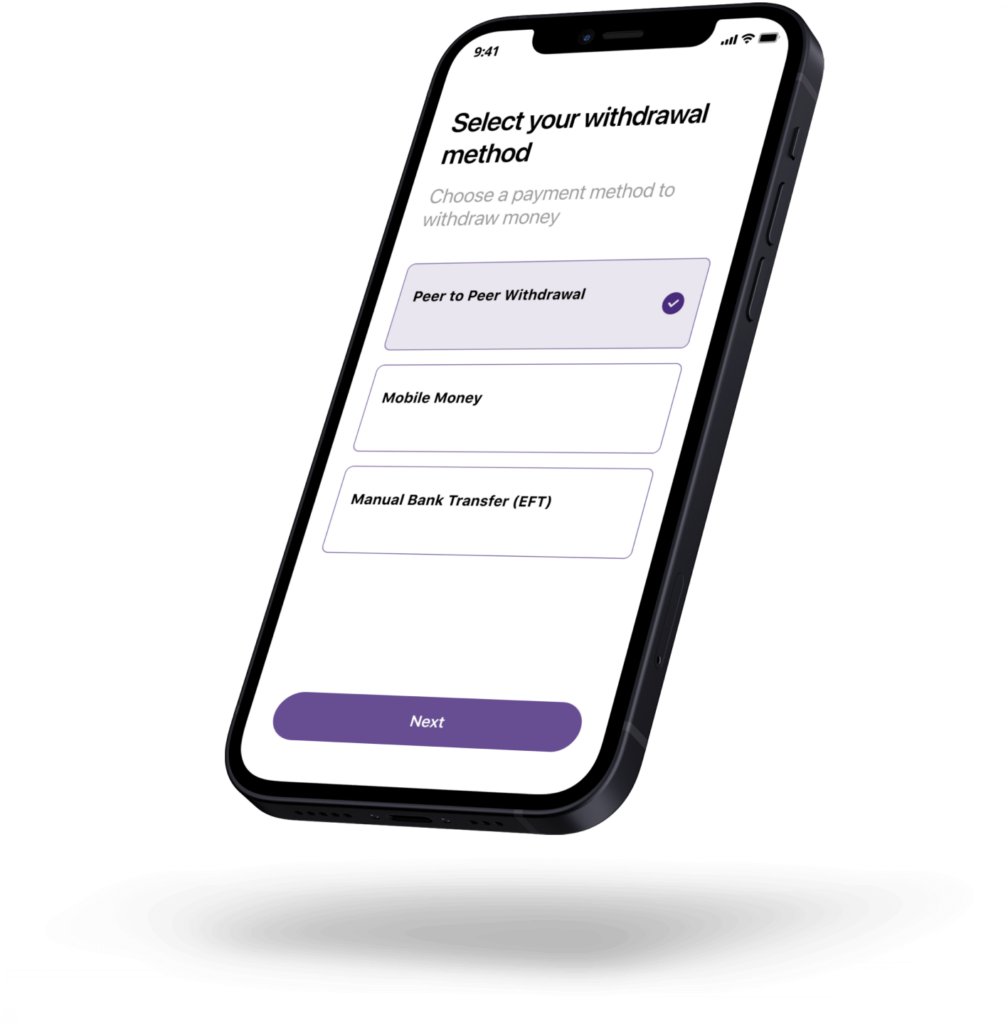

Founded in Nigeria in 2019, and in South Africa in 2020, Yellow Card has rapidly expanded its footprint, now operating in 20 African countries and facilitating more than $3 billion in transactions. The company positions itself as the largest and first licensed stablecoin on-ramp/off-ramp in Africa. It provides businesses with secure and cost-effective methods to buy and sell stablecoins like USDT, USDC, and PYUSD via local currencies and its Payments API.

In October 2024, Yellow Card raised $33 million in a Series C funding round to fuel its growth, develop new products, strengthen its team, and lead engagement with regulators across the continent. This funding round, led by Blockchain Capital and existing investors, including Polychain Capital, Valar Ventures, Third Prime Ventures, Coinbase Ventures, and Block, Inc. (Square/Cash App), underscores the company’s dedication to expanding its services while adhering to regulatory standards.

Securing the CASP licence in South Africa is a pivotal step for Yellow Card, as it navigates the complex regulatory landscapes of African countries. This achievement solidifies its presence in one of Africa’s largest economies and sets a precedent for other fintech companies aiming to expand within regulated environments.

Commenting on the FSCA’s decision to issue the licence to Yellow Card Financial South Africa, Chris Maurice, Yellow Card’s co-founder and CEO, said, “The CASP licence underscores Yellow Card’s commitment to its customers in South Africa and regulatory compliance across the continent.This achievement reflects our dedication to providing secure, compliant and transformative solutions for our customers both in South Africa and across Africa“.

Stablecoin adoption is surging throughout Africa, with sub-Saharan Africa having the highest adoption rate in the world at 9.2%. In South Africa alone, where the number of total users of crypto assets is estimated to amount to 5.8 million people, stablecoins have experienced growth of 50% month over month since October 2023, displacing bitcoin as the country’s most popular cryptocurrency. Yellow Card is excited to play a pivotal role in this financial revolution in South Africa.

“We look forward to building on our licence stack in South Africa and exploring how that will enable further opportunities, not only in South Africa and the SADC region, but across the continent,” the company said.